At Lakeside Acquisitions we understand that no two companies and no two deals are the same.

We take the time to understand the nuances and intricacies of your business in order to represent you successfully and secure the best terms.

We prepare for the inevitable hurdles that come with finding the right deal, allowing us to navigate each step of the process as efficiently as possible. We typically refer to ourselves as “the quarterback” of the deal, working in tandem with you, your attorney and your accountant to execute the strategic “game plan”.

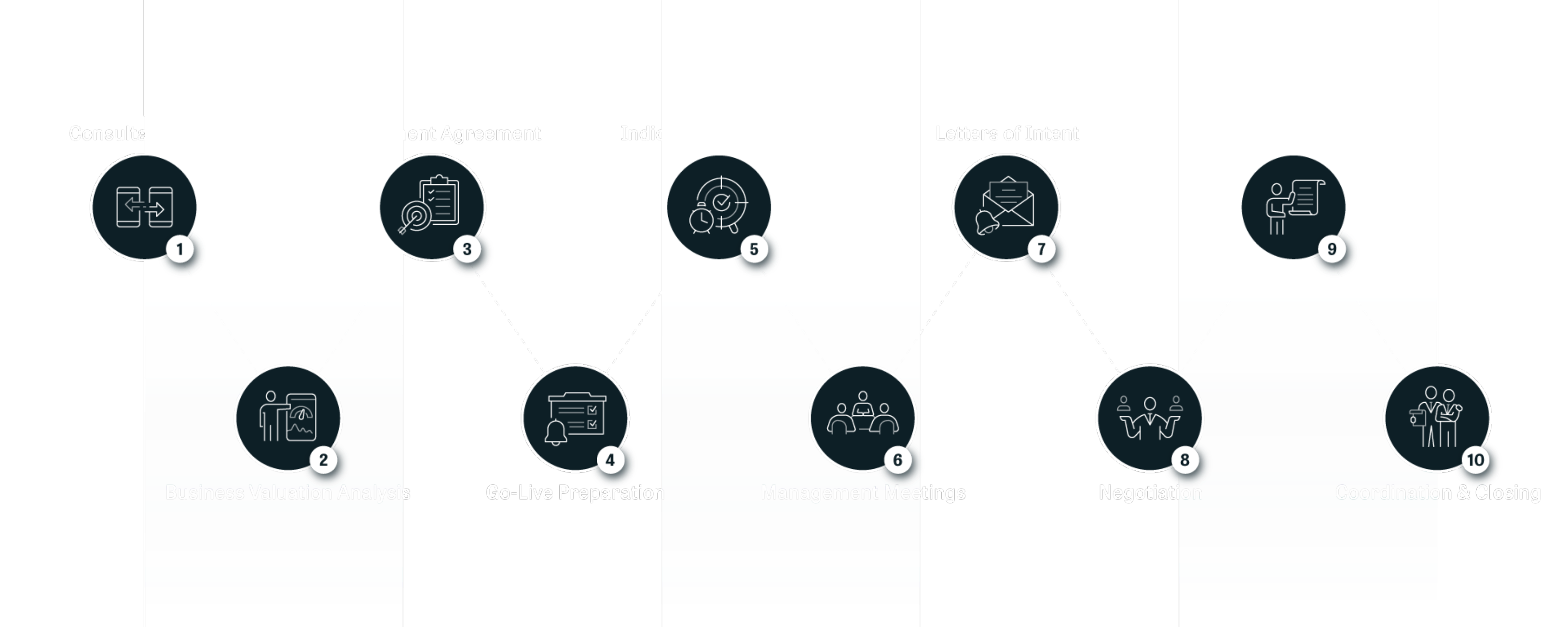

The Process

1. Consultation Call

We aim to learn about your business and exit strategy goals and provide insight on today’s M&A market and our in-depth process.

2. Business Valuation Analysis

We analyze key business information to estimate a probable sale price range for your business, including your walk away proceeds after paying off debt, fees, and estimated taxes.

3. Engagement Agreement

12-month exclusive contract, including an engagement fee to be paid upfront and a success fee to be paid at closing.

4. Go Live Preparation

Lakeside will build out a targeted buyer list, a secure data room, and comprehensive marketing materials for your approval.

5. Indications of Interest

On a preset deadline, buyers must submit a high-level interest letter including terms of sale. We will review all offers with you and invite select buyers to management meetings.

6. Management Meetings

Meetings and site visits with each prospective buyer to answer additional questions and determine a best fit for your company.

7. Letters of Intent

Deadline for buyers to submit a letter of intent including all terms of sale (e.g. price and structure, financing contingencies and sources, timeline for due diligence and closing, and management plans).

8. Negotiation

We handle all of the buyer discussions, negotiating terms until we have an agreement and executed letter of intent from both parties.

9. Due Diligence

A 3-4 month period for the buyer to perform a thorough review of your company, including weekly meetings to keep closing on track and mitigate buyer concerns.

10. Coordination & Closing

Lakeside and attorneys coordinate all necessary legal documents and information to close and complete the sale.

Let us achieve maximum value for your company.

Schedule a call